In contemporary society, where everything happens at lightning speed, it is essential for individuals and organizations to effectively manage their finances. Monitoring cash transactions remains the key facet of finance management. There are several applications that can make this process much easier, including Cash Bill (บิลเงินสด, which is the term in Thai) and Cash Bill Excel. These systems simplify the process of financial administration by recording, categorizing, and analyzing cash transactions. This article will discuss the advantages and functions of Cash Bill and Cash Bill Excel with respect to the improvement of one’s financial operations.

Recognizing Cash Bills and Their Significance

Let us put some light on cash bills and its significance:

What is a Cash Bill?

Cash bills are documents that contain specific details about the financial transaction between a seller and a buyer. It typically provides information on the date of sale or purchase transaction, quantity, price, and total value paid by the purchaser of the goods purchased. Unlike invoices with credit terms, cash bills indicate full payment at the time of sale.

Cash bills are very important in business because they are needed for taxation and accounting purposes, provide evidence of purchases, and help monitor sales. They also ensure that transactions are transparent while giving customers an easy reference point.

Why Use Cash Bill Excel?

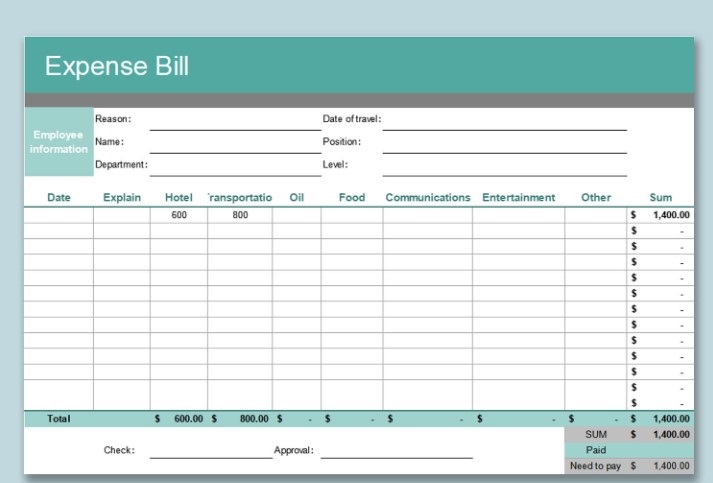

Cash Bill Excel (บิลเงินสด excel, which is the term in Thai) is a software that is designed to create, arrange, and examine cash invoicing easily within Excel’s range. With the use of this application, it is possible for businesses to automate their cash bill generation process, which minimizes human error and saves time. Moreover, it also contains a customizability option that allows companies to adjust fields and styles according to their personalized requests.

What are the Advantages of Cash Bill Excel

Let us discuss the benefits of cash bill Excel:

Simplified Documentation

Cash Bill Excel is an efficient and easy way to keep records, which is one of its main advantages. Instead of making cash bills from scratch, businesses can use pre-existing Excel templates. In such templates, total amounts, taxes, and discounts are calculated automatically for maximum accuracy and efficiency.

Data Analysis and Reporting

Generating currency notes and performing data analysis can be done using Cash Bills Excel. It is easy for corporate organizations to prepare reports, analyze sales trends, and monitor their cash flow activities. This data-driven method enables companies to pinpoint areas for improvement and make more informed choices concerning their finances.

Conclusion

The Cash Invoicing tool and its Excel version are vital for facilitating cash dealings. With Cash Bill Excel, businesses can increase reliability, speed up data entry, and gain insights into their financial performance. For either a small business or a large corporation, these technologies can greatly simplify your finance management practices. Consequently, this will enhance orderliness and aid in making informed decisions.